A year of transformation, but a tough year

Key points

1. Financials

- Group Revenue rose slightly to $248.1m from $243.2m in the previous corresponding period (pcp).

- Reported net profit after tax was $53.9m million compared to $76.8m for the pcp. Underlying profit after tax was $45.0m compared to $59.2m for the pcp, as a result of reduced space due to automation work, the loss of a service and a cyclical decline in car volumes.

- Capital expenditure increased to $104.8m ($96.5m pcp) to increase capacity and productivity, and improve safety.

- To fund our investment programme, no final dividend has been declared. An interim dividend of $18.6m was paid ($51.1m pcp). For the financial years ending 30 June 2020 and 2021 Ports of Auckland anticipates paying a dividend of 20% of after-tax profits, reduced from 80%, in order to fund the investment programme.

2. Volumes

- Container volumes are down 3.5% to 939,680 TEU (Twenty-foot Equivalent Units) compared to 973,722 TEU for the pcp.

- Car and light commercial vehicle volumes were by down 14% to 255,252 units, compared with 297,678 units for the pcp.

- As a result, bulk and breakbulk volumes (including cars & light commercial vehicles) were down 3.3% to 6.5 million tonnes compared to 6.8 million tonnes for the pcp. Non-car bulk and breakbulk volumes rose 7.4% to 3.7 million tonnes.

3. Our people

- Our people have had to deal with a tragedy this year, with the death of a colleague as a result of a straddle accident. This accident has reinforced our determination to engineer out safety risks wherever possible.

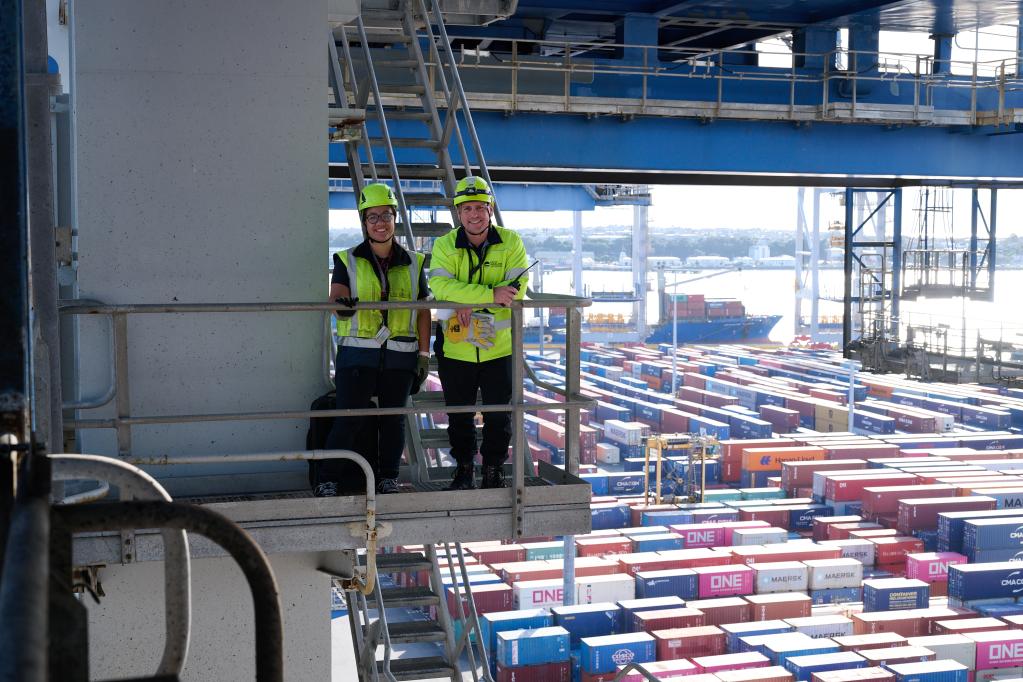

- In a New Zealand first, we have installed lash platforms onto our cranes so our stevedores will no longer have to work on the quay where heavy machinery operates.

- Automation will bring many changes to the port, and we are delivering a comprehensive training and support programme before and after automation goes live.

4. Customers

- Automation will bring significant benefits but having to automate an operating terminal has been difficult, as expected. Capacity was reduced, congestion increased, and productivity fell. Container crane rates averaged 32.50 moves per hour (mph), down from 35.63 mph the previous year.

- To avoid any risk of disruption during this year's import season, the automation go-live will commence in February 2020.

- Multi-Cargo operations continued to perform well, despite the car terminal area being reduced by 10% during construction of a car handling building. Car dwell time reduced to an average of 2.42 days, down from 2.90 for the pcp.

5. Transforming the port

- Significant progress has been made on the automation of our container terminal. Most infrastructure work is complete, and we are now in the final phase of testing.

- We have started construction of a new car handling building, which will increase capacity at our car terminal. It is due to be completed in August 2020.

- We took delivery of three new container cranes, and commissioning has now been completed. The cranes are being used in automation testing.

- We opened the first customer facility at our Waikato Freight Hub and completed construction of a new road connection to the hub.

- As part of our plan to reduce our emissions to zero by 2040, we have bought the world's first electric tug, and announced plans to build a demonstration hydrogen production and refuelling facility which is due to open in 2020.

- We have received consent to dispose of dredged material at sea, in one of five official New Zealand disposal sites.

- We are preparing a consent application to deepen our shipping channel and are aiming to lodge the application later in 2019.

Ports of Auckland today released its results for the 2018/19 financial year.

Chief Executive Tony Gibson said, "It has been a challenging year, but also a productive one."

"It has been a year of incredible lows, with the death of our colleague when the machine he was driving tipped over. This was a tragic event and it has deeply affected everyone at the port. Our thoughts are with his family and friends."

"It is also a year in which we've made significant progress in transforming our business and preparing for the future. We have completed most of the infrastructure work for automation and we are in the final stages of testing before going live next year. Construction of our new car handling building is going well, we gained consent to dispose of dredged material at sea and we will soon seek consent to deepen our channel for larger container ships."

"We are making good progress on our rail-linked network of Freight Hubs, passing a significant milestone with the opening of the first customer facility at our Waikato Freight Hub for Open Country Dairy, in April. We have also completed construction of a new bridge and road access to the site."

"Volumes and profits are down this year as a result of reduced space due to automation work, the loss of a service and a cyclical decline in car and light commercial vehicle volumes."

"As a result of the need to fund our investment programme, we reduced our dividend level and have not declared a final dividend for the FY19 year. For the financial years ending 30 June 2020 and 2021 Ports of Auckland anticipates paying a dividend of 20% of after-tax profits. For this year (FY19) we have paid an interim dividend of $18.6m. Once automation is live and the peak of investment has passed, we will again be able to deliver a higher return and dividend level."

"Thanks to the hard work and dedication of our people, we continued to deliver good operational performance despite all the work taking place on the port. Our container crane rate fell, but not by much, and our multi-cargo team actually managed to speed up the removal of cars from the wharf. This is particularly notable given our dwell times were already world class."

"Automation brings significant productivity and sustainability benefits, but it also impacts some of the traditional roles in our industry. We believe that a business like ours which is adopting new technologies has a responsibility to help staff and their families adapt. We have initiated a Future of Work programme where our staff can learn and manage these new opportunities."

"We continue to value and empower our people by focusing on maintaining a positive safety culture, embracing diversity, and investing in training and development. Our new lash platforms emphasise our commitment to safety, as they physically separate pedestrian stevedores from straddles thereby eliminating one of our 'critical risks'. We are the first port in New Zealand to introduce this innovation, and one of only a few in the world."

“Overall, the company is in good shape and good heart. The projects underway are a significant investment in our future and they are going well. We look forward to the year ahead, as automation comes on stream and we begin to see the results of the hard work of the last few years.”

The Ports of Auckland 2019 Annual Report can be found here:

ENDS

For further information contact:

Matt Ball

Head of Communications

Ports of Auckland

M: +6421 495 645

E: [email protected]